Today we are going back to the basics, and we are going to discuss some general, but powerful ways to improve your finances. While we will attempt to summarize each of the steps into one paragraph each, it is important to know that each step is a financial mountain in-and-of itself.

These steps will take effort, and repetition in order to establish them as mainstays in your daily life rather than “something you tried once.” This can either be a financial crash diet, or a financial life change.

1. Set A Schedule:

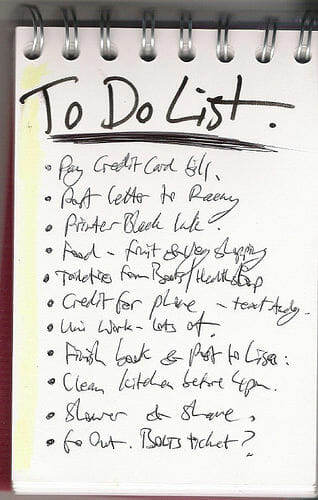

You need to set up a schedule to work on your finances. Once a month is a start, Bi-weekly is better, weekly is ideal, but may be hard to sustain. It would be better if you could set specific hours as well. The more specific you are, the easier it will be to not put it off until “later.”

You should also select a place that will offer few distractions. I’m sure you have a lovely family, but it may be necessary to go to the library until you have this down to a science. If you have a spouse then include them! Finances in marriage is a topic we’ve covered before and it’s important to know how to manage it.

2. Gather Statements:

You need statements! Print your bank statements, bring your pay stubs, bring your bills, and any other papers that will help you understand what you have earned or spent. Try to see what your monthly cash-flow looks like. Take the amount of money that you’ve earned this month and subtract all of your bills and expenditures from it. Is it negative? If so, you’ve got a lot to do. Is it positive? How positive is it? This is the amount of money left over after everything has been paid, and hopefully it is enough to let you save and invest properly.

3. Categorize & Cut Spending:

Categorize your spending & bills to figure out where you can cut your spending. Think of possible alternatives that may make things cheaper. Are you maximizing your coupon use? Could you cut that phone bill down a bit? Can your spouse cut your hair, or take care of the lawn? If it isn’t necessary to live, then chances are you can do something to make it cheaper. Your commitment in this step could very well decide the direction that your finances will go for the rest of your life.

4. Distinguish Your Debts:

Debts are a common thing in today’s society, and they are certainly nothing new! You need to jot down your debts, and the monthly payment amounts. Debt can be a nasty monster, but you can be victorious if you can commit to a plan. You need to address all of your debts and be completely honest.

5. Use a Budget:

Yes, the dreaded budget is necessary. You must budget everything and do it in excruciating detail. The beauty of it is that once you have done a budget you only have to make minor adjustments to it each month. The first budget is always the hardest, but once it is established and you have the system down it gets much easier. Be sure to account for every penny, we will be more specific in the next step. Another great option is the good, old-fashioned envelope budget.

6. Control Spending:

Once you have cut some of the unnecessary fat, you need to control your financial outflow. This is done with your budget. With the previous 5 steps completed you should be able to easily ballpark how much you earn, how much you spend, and how much is left over. Nothing should be left over! You need to delegate “leftover” money! You need to put a specific amount towards each of your debts and a specific amount towards savings. Every penny must be accounted for.

7. Avoid minimum payments:

I do not advocate paying the minimum, but if you do that for a while to establish an emergency savings then it is acceptable. Whatever you do, don’t languish in your debt by unnecessarily paying the minimum amounts due!

8. Re-delegate your free cash:

As you get better at cutting your spending and saving your money, your remaining money at the end of the month will continue to grow. It is important to re-delegate this money either into your debt, into your savings, or into a combination of both. It is important to re-delegate this money. Some people believe that money sitting in the account is the same as money delegated to savings, but this is simply not true, at least not in the beginning. If you don’t delegate it, then you may subconsciously view the money as spendable because you’ve already funded savings, but if you include it in savings, then it has been spoken for.

9. Track your progress:

This can be done a number of ways but the easiest way is to use a whiteboard or if you are proficient in Excel then you can absolutely use that. What you should do is take the amount of money you earned, subtract your spending, subtract your bills, and subtract your debt payments and mark that amount on the chart for the month. This will help you to see if you have more money going out than coming in, and it will help to motivate you into doing better.

10. Pay off debt:

In most peoples’ finances, debt accounts for a lot of the monthly outflow. It is important to pay this debt off in order to increase your retained money. If you eliminate your debts, then the money that would have otherwise been going to it can now be directed to other aspects of the budget, most importantly your savings! More savings means less need for debt.

Excellent Articles:

- Invest It Wisely: Escaping the Rat Race

- Bucksome Boomer: Back To School Sales Aren’t Just For Kids

- Everyday Tips: Do You Take Advantage of Free Stuff?

- Financial Samurai: The Four Different Ways To Spend Money

- Money Smart Life: Pay off your mortgage VS. Pay down your mortgage

Photo Credit: Ebby