Build Wealth With Passive Income

Build Wealth With Passive Income

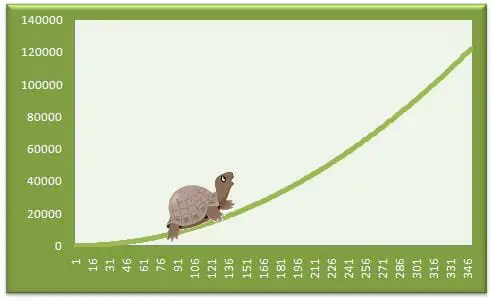

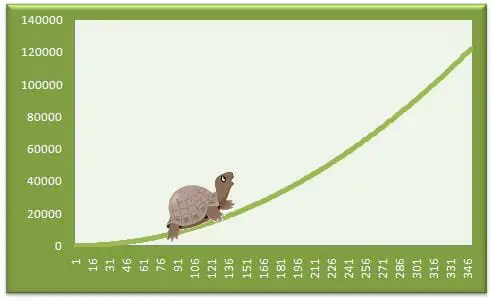

You may have read about how passive income is important and that even millionaires and billionaires use it to their advantage. Passive income is very much a “brick by brick” approach, and won’t result in your being rich over night, but over time it will build a nearly impenetrable wall of steady wealth. Passive income is a beautiful thing, but like all other things, you must not put all of your eggs into one basket! If you purchase a single dividend paying stock throughout your whole working life, then your retirement and income depend solely on the success of that one company! We don’t know about you, but we don’t have that much faith in any single company.

Diversify Your Passive Income

Diversification is the goal of most investors. The idea behind diversification is to place your money in different areas, or sectors of industry, and if one is doing bad, then the others will hopefully be doing well enough to compensate. It is important to build up a solid, diversified portfolio, or dividend generating investments. Now, you most certainly can sit down with a qualified financial advisor to choose your diversification goals, but another easy way to diversify is with investments such as ETFs, and Mutual Funds.

These are investments that consist of a basket of various stocks, bonds, or mutual funds. In short, they are already generally diversified. This does not mean that you should not look at your portfolio’s diversification, or that you still shouldn’t consult with an advisor, but it is a great way to start out investing in dividends without placing all of your eggs in one basket.

Monthly Passive Income

You can find stocks, bonds and mutual funds that pay out dividends Monthly, Quarterly, and Annually. Many will pay out their dividends quarterly usually because that is how they do their earnings. If you are looking for monthly dividends then you can find some ETFs and Mutual Funds that are setup with this goal. These are usually considered income funds and will often contain bonds in them. This is more of a steady retirement investment but we enjoy using them because it is fairly dependable passive income.

Often times, dividends will not have very impressive dollar amounts, but when you build the number of shares up, these small monthly inflows will eventually grow into substantial income. You have to build your “passive income wall” brick by brick, but once you do, you will have a very healthy, strong, and impenetrable wall of wealth standing between you and living paycheck to paycheck.