If you like what you read, then subscribe to our feed!

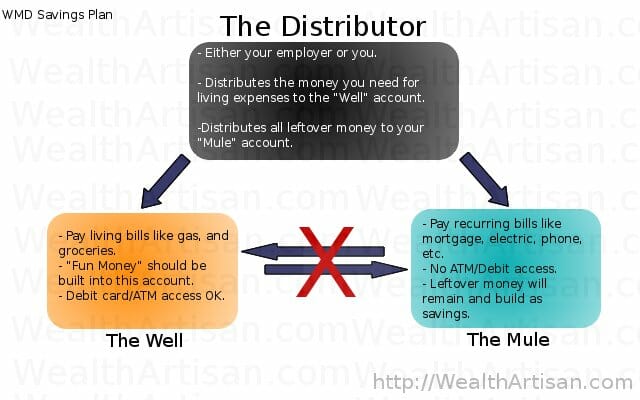

No, we’re not talking about weapons of mass destruction, but with this method, you can absolutely destroy your debt! What is the WMD Savings Method? It is an acronym that means the Well, the Mule, and the Distributor. Each of these are symbolic pieces of a 3 part savings/budgeting plan. During the next week, we will be going into more depth, but here is a general overview.

When I say that this is a savings plan, it’s more of a forced budget that results in left over money, when done properly. This left over money should then build into a reasonably sized savings.

The Well

The well is the piece of the method that you live off. You “draw” your everyday living expenses from it like you do water from a well. The “water” comes from the distributor, but that will be explained later. For now, you just need to know that your “well” account is the account that you would use for groceries, gas, and any other everyday type expenses you might incur. The well is only meant for your consumption.

The Mule

The mule is the workhorse of the 3, it pays your bills, and it builds the savings. Every pay period you load the mule down with all of the heavy work that needs to be accomplished. One important note, the mule isn’t allowed to drink from the well!

The Distributor

The distributor does exactly that, it distributes the money into your “well” account and your “mule” account. This will often be your employer if they support direct deposits, but if your employer doesn’t do that, then you very well can be the distributor, but it will require commitment on your part!

How Does It Work?

We will delve further into each of the accounts over the coming week, but this is a general overview. If you have any questions about anything, feel free to ask, but I’m sure many will be answered in the upcoming posts.

The premise is to estimate how much money you need to live off of each pay period for groceries, gas and any other non-recurring bills, and that is the money that goes into your well account. All of the remaining money goes into the mule account and it sits there to pay your monthly bills like your mortgage, your electricity, your phone bill, cable, etc. At the end of the month, after all of your bills are paid, the remaining money can stay there and continue to build up.

Eventually, this money will become your savings. The well account is the account you should have debit card access to, the mule account you should only have check access to. It’s better to keep the accounts in separate institutions to decrease the temptation to transfer money.

FAQ

How do you know this works?

This is the method that my wife and I use to save money. It forces us to live on a fixed amount of money, and all of the remainder (including bonuses!) goes into our mule account where we can barely touch it! Now, we no longer feel the need to use the money in the mule account for anything outside of bills and savings, but why fix what isn’t broken?

How do I know how much should go in the Well account?

Look at your grocery bills, gas bills, and any other everyday expenses you incur and forecast a worst case scenario. It’s better to over-estimate at first until you get a better idea of how much you truly need to put into the well account. The nice thing about doing this is that you will see how much money you’re actually consuming, and often it is a startling number to see!

How do I know how much should go into the Mule account?

This one is easy, it is the balance. Whatever your pay was for the pay period minus what goes into your well account. If you’re a more mathematical person then it would look like this:

(Pay Check) – (Well Account Funds) = (Mule Account Funds)

Limited Access, and no debit card for the mule account?

Yes, limited access is important. It forces you to have restraint. When you pick the amount of money to live from in the well account, you are stuck with that amount with limited access to the funds in your mule account. No ATM access, no debit card access, and checks as your only means to access these funds. It forces you to be more responsible.

Why should the Well and Mule accounts be at different banks?

Because it won’t allow instant transfers of money. It will require you to wait a few days to gain access to the money, and during this time you’ll be able to better think about why you want to use this money. Most banks allow instant transfers between accounts at the same bank, this will prevent you from doing that to buy a TV on a whim.

What should I do if my employer doesn’t do direct deposit, or only deposits to 1 account?

Then you’ll need to stand in as the distributor by manually funding the accounts. This will require you to determine the amount to live on, and then write a check for the balance to your mule account. It’s always good to speak with your employer to see if they do offer direct deposit. Many employers do, they might have just done a poor job of communicating it.